Business reporter & Deputy economics editor, BBC News

Getty Images

Getty ImagesThe Bank of England has hinted at further interest rate cuts, which could come as soon as August.

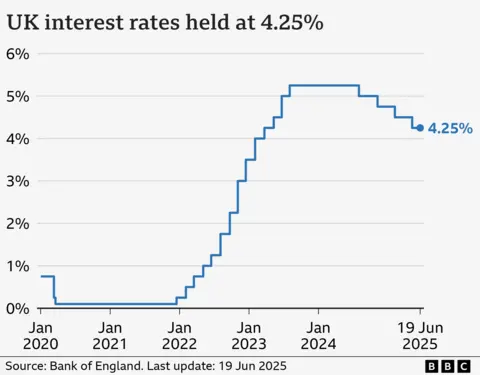

It decided to keep rates at 4.25% on Thursday with inflation, the rate prices rise at over time, remaining at its highest level for more than a year and above the Bank’s target rate.

Governor Andrew Bailey said interest rates “remain on a gradual downward path”, but warned: “The world is highly unpredictable.”

There are concerns that the conflict between Israel and Iran, a major oil producer, could send energy costs higher and drive overall prices up, which would impact further rate decisions.

Clare Lombardelli, deputy governor of the Bank of England, told the BBC that the “uncertainty facing the economy” led to interest rates being held this month.

Describing events in the Middle East as “tragic” and “deeply worrying”, she said: “As you’d expect, we are monitoring carefully those events and the impact that those will have.”

Since the bank’s rate-setting committee last met in May, oil prices have risen by 26% while gas prices have grown by 11%.

Ms Lombardelli said: “We’ve seen oil prices, for example, increase since the attacks. But we’re thinking about and focussed on the impact for UK inflation and so we’re monitoring and carefully assessing those events.”

The bank marginally lifted its expectations for the UK economy but it said that underlying growth was “weak”.

UK growth has been uneven so far this year, with the economy expanding strongly at the start of the 2025, before shrinking sharply in April.

There has been evidence that the pace of wage growth – which contributes to the rate of inflation – is slowing. At the same time, the UK’s unemployment rate has risen and businesses are holding off on recruiting or replacing staff.

“In the UK we are seeing signs of softening in the labour market. We will be looking carefully at the extent to which those signs feed through to consumer price inflation,” said Mr Bailey.

The Bank’s base interest rate dictates the rates set by High Street banks and lenders.

The higher level in recent years has meant people are paying more to borrow money for things like mortgages and credit cards, but savers have also received better returns.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said two interest rate cuts were “still on the horizon” this year.

“In every direction, there’s a conundrum to confront, so policymakers have judged that pressing the pause button on rates is the best option for now,” she said.

“Hopes for a summer rate reduction haven’t completely faded, with bets ramping up that a cut in August could provide the rays of relief that borrowers have been waiting for.”

Pressure growing on businesses

Businesses appeared to be trimming wages for some workers to pay for the rise in employment costs that came into force in April.

Employers have been hit with a rise in the amount of National Insurance they are required to pay as well as increases to the minimum wage. The Bank estimated the policy changes by Chancellor Rachel Reeves have hiked wage bills by 10%.

In its survey of businesses, it said that pressure had grown on firms to recover the higher costs by raising prices but added “success is mixed”.

Instead it said companies were using a range of measures to cut costs, including reducing pay rises for those workers just above the minimum wage level.

A weaker market for permanent staff forced Hays, the British recruitment firm, to warn that its full-year profits would fall far short of expectations.

The company highlighted reduced demand in the UK and Ireland where it expects fees to fall by 13%. Hays’ share price tumbled more than 10% to 61.97p, the lowest for more than 30 years.

Some businesses told the Bank of England that they were taking a hit to their profits rather than raising prices for customers to cover higher employment costs.

Inflation remains above the Bank target of 2%, at 3.4% in the year to May, and is expected to climb to 3.5% later this year. But it is forecast to fall back to around 2.1% next year.

Interest rates are the Bank’s main tool in trying to maintain the annual rate of inflation at, or close to its target.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act as high interest rates can harm the economy as businesses hold off on investing in production and jobs.