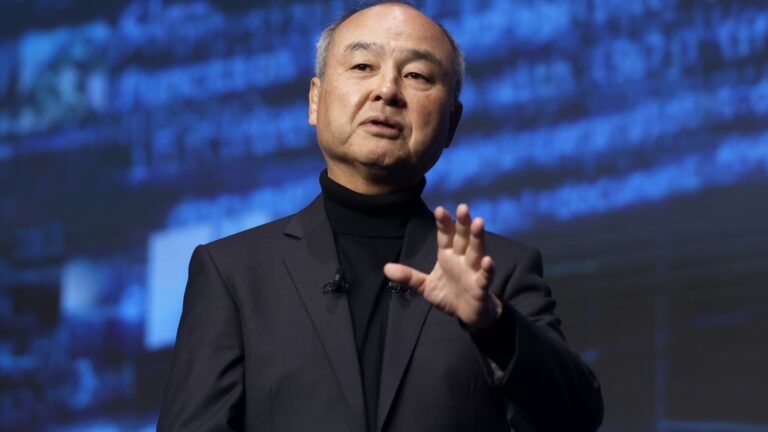

Masayoshi Son, chairman and chief executive officer of SoftBank Group Corp., speaks at the SoftBank World event in Tokyo, Japan, on Wednesday, July 16, 2025.

Kiyoshi Ota | Bloomberg | Getty Images

Masayoshi Son is making his biggest bet yet: that his brainchild SoftBank will be the center of a revolution driven by artificial intelligence.

Son says artificial superintelligence (ASI) — AI that is 10,000 times smarter than humans — will be here in 10 years. It’s a bold call — but perhaps not surprising. He’s made a career out of big plays; notably, one was a $20 million investment into Chinese e-commerce company Alibaba in 2000 that has made billions for SoftBank.

Now, the billionaire is hoping to replicate that success with a series of investments and acquisitions in AI firms that will put SoftBank at the center of a fundamental technological shift.

While Son has been outspoken about his vision over the last year, his thinking precedes much of his recent bullishness, according to two former executives at SoftBank.

“I vividly remember the first time he invited me to his home for dinner and sitting on his porch over a glass of wine, he started talking to me about singularity – the point at which machine intelligence overtakes human intelligence,” Alok Sama, a former finance chief at SoftBank until 2016 and and president until 2019, told CNBC.

SoftBank’s big AI plays

For Son, AI seems personal.

“SoftBank was founded for what purpose? For what purpose was Masa Son born? It may sound strange, but I think I was born to realize ASI,” Son said last year.

That may go some way to explain what has been an aggressive drive over the past few years — but especially the last two — to put SoftBank at the center of the AI story.

In 2016, SoftBank acquired chip designer Arm in a deal worth about $32 billion at the time. Today, Arm is valued at more than $145 billion. While Arm blueprints form the basis of the designs for nearly all the world’s smartphones, these days, the company is looking to position itself as a key player in AI infrastructure. Arm-based chips are part of Nvidia’s systems that go into data centers.

In March, SoftBank also announced plans to acquire another chip designer, Ampere Computing, for $6.5 billion.

ChatGPT maker OpenAI is another marquee investment for SoftBank, with the Japanese giant saying recently that planned investments in the company will reach about 4.8 trillion Japanese yen ($32.7 billion).

SoftBank has also invested in a number of other companies related to AI across its portfolio.

“SoftBank’s AI strategy is comprehensive, spanning the entire AI stack from foundational semiconductors, software, infrastructure, and robotics to cutting-edge cloud services and end applications across critical verticals such as enterprise, education, health, and autonomous systems,” Neil Shah, co-founder at Counterpoint Research, told CNBC.

“Mr. Son’s vision is to cohesively connect and deeply integrate these components, thereby establishing a powerful AI ecosystem designed to maximize long-term value for our shareholders.”

SoftBank’s stock performance since 2017, the year that its first Vision Fund was founded.

There is a common theme behind SoftBank’s investments in AI companies that comes directly from Son — namely, that these firms should be using advanced intelligence to be more competitive, successful, to make their product better and their customers happy, a person familiar with the company told CNBC. They could only comment anonymously because of the sensitivity of the matter.

It started with and brain computers and robots

As SoftBank launched “SoftBank’s Next 30-Year Vision” in 2010, Son spoke about “brain computers” during a presentation. He described these computers as systems that could learn and program themselves eventually.

And then came robots. Major tech figures like Nvidia CEO Jensen Huang and Tesla boss Elon Musk are now talking about robotics as a key application of AI — but Son was thinking about this more than a decade ago.

In 2012, SoftBank took a majority stake in a French company called Aldebaran. Two years later, the two companies launched a humanoid robot called Pepper, which they billed as “the world’s first personal robot that can read emotions.”

Later, Son said: “In 30 years, I hope robots will become one of the core businesses in generating profits for the SoftBank group.”

SoftBank’s bet on Pepper ultimately flopped for the company. SoftBank slashed jobs at its robotics unit and stopped producing Pepper in 2020. In 2022, German firm United Robotics Group agreed to acquire Aldebaran from SoftBank.

But Son’s very early interest in robots underscored his curiosity for AI applications of the future.

“He was in very early and he has been thinking about this obsessively for a long time,” Sama, who is author of “The Money Trap,” said.

In the background, Son was cooking up something bigger: a tech fund that would make waves in the investing world. He founded the Vision Fund in 2017 with a massive $100 billion in deployable capital.

SoftBank aggressively invested in companies across the world with some of the biggest bets on ride hailing players like Uber and Chinese firm Didi.

But investments in Chinese technology companies and some bad bets on firms like WeWork soured sentiment for the Vision Fund as it racked up billions of dollars of losses by 2023.

Vision but bad timing

The market questioned some of Son’s investments in companies like Uber and Didi, which were burning through cash at the time and had unclear unit economics.

But even those investments spoke to Son’s AI view, according to the former partner at the SoftBank Vision Fund.

“His thought back then was the first advent of AI would be self-driving cars,” the source told CNBC.

Again this could be seen as a case of being too early. Uber created a driverless car unit only to sell it off. Instead, the company has focused on other self-driving car companies to bring them onto the Uber platform. Even now, driverless cars are not widespread on roads, though commercial services like those of Waymo are available.

SoftBank still has investments in driverless car companies, such as British startup Wayve.

Timing clearly wasn’t on Son’s side. After record losses at the Vision Fund in 2022, Son declared SoftBank would go into “defense” mode, significantly reducing investments and being more prudent. It was at this time that companies like OpenAI were beginning to gain steam, but still before the launch of ChatGPT that would put the company on the map.

“When those companies came to head in 2021, 2022, Masa would have been in a perfect place but he had used all his ammunition on other companies,” the former Vision Fund exec said.

“When they came to age in 21, 22, the Vision Fund had invested in five or six hundred different companies and he was not in a position to invest in AI and he missed that.”

Son himself said this year that SoftBank wanted to invest in OpenAI as early as 2019, but it was Microsoft that ended up becoming the key investor. Fast forward to 2025, the Vision Fund — of which there are now two — has a portfolio stacked full of AI focused companies.

But that period was tough for investors across the board. The Covid-19 pandemic, booming inflation and rising rates hit public and private markets across the board after years of loose monetary policy and a tech bull run.

SoftBank didn’t see that time as a missed opportunity to invest in AI, a person familiar with the company said.

Instead, the the company is of the view that it is still very early in the AI investing cycle, the source added.

Risk and reward

AI technology is fast-moving, from the chips that run the software to the models that underpin popular applications.

Tech giants in the U.S. and China are battling it out to produce ever-advancing AI models with the aim of reaching artificial general intelligence (AGI) — a term with different definitions depending on who you speak to, but one that broadly refers to AI that is smarter than humans. With billions of dollars of investment going into the technology, the risk is high, and the rewards could be even higher.

But disruption can come out of no where.

This year, Chinese firm DeepSeek made waves after releasing a so-called reasoning model that appeared to be developed more cheaply than its U.S. rivals. The fact that a Chinese company managed the feat, despite all the export restrictions for advanced tech in place, rocked global financial markets that were betting the U.S. had an unassailable AI lead.

While markets have since recovered, the potential of surprise advances in technology at such an early stage in AI remains a big risk for the likes of SoftBank.

“As with most technology investments the key challenge is to invest in the winning technologies. Many of the investments SoftBank has made are in the current leaders but AI is still in its relative infancy so other challengers could still rear up from nowhere,” Dan Baker, senior equity analyst at Morningstar, told CNBC.

Still, Son has made it clear he wants to set SoftBank up with DNA that will see it survive and thrive for 300 years, according to the company’s website.

That may go some way to explain the big risks that Son takes, and his conviction when it comes to particular themes and companies — and the valuations he’s willing to pay.

“He (Son) made some mistakes, but directionally he is going in the same driection, which is — he wants to be sure that he is a real player in AI and he is making it happen,” the former Vision Fund exec said.