Business reporters

Getty Images

Getty ImagesOil prices rose 1% on Monday, hovering above $77 per barrel, after Iran threatened to shut down the Strait of Hormuz in the aftermath of the US’s attack on the country.

It was a surprisingly muted reaction to a threat to close one of the world’s most important oil shipping routes.

The price of Brent crude oil had risen to its highest in five months as markets opened, but fell back by mid-morning.

However, oil is still trading more than $10 higher than it was in May, having jumped after Israel’s strikes on Iran earlier this month.

It has led to fears that increased energy costs could make everything – from petrol and food to holidays – more expensive around the world, including in the UK.

That is what happened after Russia invaded Ukraine three years ago, affecting people’s lives around the globe.

Why is the Strait of Hormuz so important?

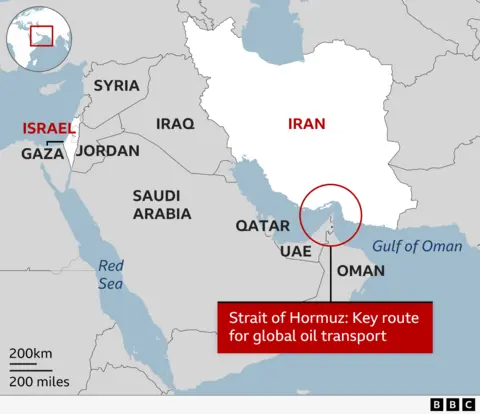

The Strait of Hormuz is a channel between Iran and the northernmost tip of Oman, linking the Persian Gulf with the Arabian Sea. At its narrowest point it is just 33km (20 miles) across – about the same width as the English Channel.

It is one of the world’s most important shipping routes. On any given day, about a fifth of the world’s oil and gas, worth $600bn, passes through it, from Gulf states such as Iraq, Kuwait, Saudi Arabia, the United Arab Emirates, Qatar and Iran itself.

On Sunday night, Iran’s Press TV reported that the country’s parliament had approved a measure to close the channel, a move which would have profound consequences for global shipping.

Why haven’t oil prices reacted more?

Analysts at Goldman Sachs have suggested the worst-case scenario could lead to the supply of oil through the Strait of Hormuz halving for a month and dropping 10% for another 11 months. This would lead to the price of Brent crude peaking at $110 per barrel, they say.

For now, though, traders are content that the risk of Iran actually closing the Strait of Hormuz is limited.

“It would be difficult for Iran to fully close the Strait of Hormuz for an extended period due to the position of the US Navy’s Fifth Fleet in Bahrain,” wrote Helima Croft, head of global commodity strategy at RBC Capital Markets.

“I think it’s pretty unlikely,” adds Simon French, chief economist at Panmure Liberum.

That’s partly because Iran may come under pressure from its allies to keep the channel open.

“China’s role in all this is pretty significant, because they can decide whether they want to provide financial support and military support to Iran, and they won’t do that if they think that a key provider of their oil is going to be disrupted,” says Mr French.

Will this affect energy bills and petrol prices?

Any conflict in the Middle East is bound to affect global energy prices, which has a knock-on effect on bills and petrol prices.

Oil prices have already risen steeply since the beginning of the conflict. In the aftermath of Trump’s so-called “Liberation Day” tariffs at the beginning of April, Brent crude prices dropped as low as $60.

But the conflict in the Middle East has “unwound all the impact of tariffs on energy markets”, says Mr French, pushing prices back to where they were at the end of March.

One of the biggest concerns for British households would be a rise in liquefied natural gas (LNG) prices. Although the UK procures most of its LNG from Norway, any blockade in the Strait of Hormuz would push up prices around the world.

Craig Lowrey, principal consultant at Cornwall Insights, says household bills are safe from any volatility for now, because the energy regulator, Ofgem, has already announced the energy price cap for July until September. But if this conflict continues past September, household bills could rise.

And businesses, which aren’t subject to the cap, could be hit more immediately. “That would certainly be a challenge,” he says.

Consumers could see a more immediate effect in prices at petrol pumps . “There’s a lag of three or four weeks as the oil goes through the refining system,” says Mr French.

If Brent does reach $100, “you’re staring down the barrel of 155p, 160p at the pump, which will be quite a shock”, he says.

Prices at the pump have already begun to creep up. “The average price of a litre of petrol has increased by 1.5p to 133.5p in the last week while diesel has gone up by 2p to 140p,” says Simon Williams, head of policy at the RAC.

However, he adds prices were a “long way off” those seen in spring 2022 when Russia had just invaded Ukraine.

What does this mean for global economies?

Any sustained rise in oil prices will cause the prices of everyday goods to rise in economies around the world as the cost of manufacturing and transporting them increases, which in turn will push up inflation.

In mid-June, Capital Economics suggested that if oil prices were to rise to over $100 a barrel, that could add 1% to inflation in advanced economies, making life difficult for central banks hoping to bring down interest rates.

“In the US, the Federal Reserve has already signalled a pause in its easing cycle, citing ‘geopolitical risks to price stability’,” says Garry White, chief investment commentator at Charles Stanley Group.

“In Europe, inflation expectations have ticked upward for the first time in months.”

Developing economies in Asia and Africa are particularly vulnerable, he adds. “Many rely heavily on Middle Eastern oil and gas imports and lack the financial buffers to absorb sudden price spikes.”

If inflation rises, the Bank of England could also slow down, or even halt, its programme of interest rate cuts. Mr French predicts that, if prices rise to $110 a barrel, UK inflation could rise above 4% from its current 3.4%.

“That becomes a very difficult environment [for the Bank of England] to keep cutting interest rates like they have been doing,” he says.